CROSS LINE OF CONTROL TRADE: TRENDS, OBSTACLES AND OPPORTUNITIES

Faizur Rehman* Ghazal Humayun Khawaja**

Abstract

This paper will examine the existing trends in Cross LoC Trade, hurdles in its sustainability and future opportunities by the direct involvement of civil society. The LoC was officially opened in 2005 for the movement of people followed by Cross LoC Trade since its closure in 1947. Its main objective was to reduce the tension between India and Pakistan over Kashmir conflict by making the borders irrelevant through people to people contact. The role of civil society in continuation of Cross LoC Trade has been promising since its inception; however, it has been a challenge for authorities on both sides of LoC as far as its sustainability is concerned because the trade stability is directly linked with the political relationship between India and Pakistan. Besides many hurdles, its economic aspect is very important as the involvement of civil society in trade activities will certainly create intoxicating power against the dominant antagonistic attitude prevailing in the region which can drive both the unfriendly states toward peaceful resolution of the conflict.

Key words: Barter Trade, Trade In, Trade Out, T&TA, SOPs, AK, J&K, LoC, MoU.

Introduction

The division of the former Princely State of Jammu & Kashmir (henceforth Kashmir) in 1947 not only divided the families of Jammu and Kashmir but also circumscribed their means of communications, trade and businesses. Due to Kashmir conflict, the most important trade route of Kashmir Valley via Chakothi to Rawalpindi and beyond was closed down. However, with the dawn of 21st century, an attempt was made to reduce the source of conflict between India and Pakistan. As a confidence building measure, the permit system was introduced in 2005 for the people of two sides of divided Kashmir to travel across the Line of Control (LoC) followed by Trade in 2008. The Cross LoC trade started on the basis of barter system without any proper information and lack of direct interaction between trading partners. Though there are many hurdles in Cross LoC trade yet the new development has created a new anticipation for improvement of trade relationship between two nations as well as between divided parts of Kashmir. Particularly, the economic aspects of relationship can have a political impact on both the countries to create a space for peace in this region; however, it needs a compact policy to comprehend the trade pattern through the LoC.

The purpose of this study is to analyze the trade statistics by using the primary data collected from the office of Trade and Travel Authority (T&TA) Muzaffarabad and to point out the obstacle and the opportunities of cross LoC trade. Apart from available literature, qualitative method has been applied in this study through the direct access by collecting information through one to one in-depth interviews. Around 20-30 selected interviews have been conducted with key traders in Muzaffarabad, Rawalakot/Hajira, Mirpur/Kotli and Rawalpindi/Islamabad and also the Trade & Travel Authority in Muzaffarabad has been taken on board. Triangulation technique has been used to validate the collected date from the different sources.

Cross LoC Trade

The LoC was officially opened in 2005 for the movement of the people of Kashmir since 1949 when a Cease-fire Line (renamed as Line of Control under Simla Agreement) was drawn between the two parts of the former Princely State of Kashmir followed by the opening of Cross LoC Trade on 21st October, 2008. It was the most capable progress in recent history of Indian subcontinent as both Indian and Pakistani governments have recognized that the importance of economic collaboration which could make the LoC irrelevant for economic and human exchanges that might be a useful instrument in deciding this sixty seven years old conflict.

The governments of Pakistan and India have allowed Kashmiri traders to merchandise only twenty one (duty free) items, all of which are primary products produced within the geographical confines of former State of Kashmir. Out of these 21 items, there are certain merchandises in the list of tradable items which could not be carried out, such as saffron and furniture are its examples. The reason behind Saffron was that there was sign of impurity in it that is too grim to detect in normal conditions, while the reason of furniture was that, “there is lack of acquaintance about the samples and quality.”

Apparently, it seems that Cross LoC trade was initiated to encourage the local Kashmir-based products, however, the framed Standard Operating Procedures (SOPs) are perplexing as far as its promotion is concerned as Indian SOPs indicate that all those items listed in the agreed list would be allowed to be traded subject to the condition that products of third country origin would not be allowed to be traded.” It is clearly mentioned that the items/products produced in third country (including Pakistan) would not be allowed in cross LoC trade, however, it did not reference anything about the items manufactured in India. That is why Ginger was banned by Jammu & Kashmir authorities (Indian Held Kashmir) authorities because it was imported from China to Pakistan and “Traded Out” to J&K without removing the Chinese labels on it. In Pakistani SOPs, there is no clear policy statement regarding the products of third country origin. It seems that Pakistan has deliberately left this flexibility in its SOPs.

AJ&K Cross LoC Travel and Trade Authority

In the beginning, Civil Administration was responsible to conduct this trade activity. In order to homogenize this business activity, under Ordinance V of 2009, which was issued on 4th March 2009, Azad Kashmir Government established an authority called “AJ&K Cross LoC Travel and Trade Authority (T&TA).” The T&TA became functional from March 2010. There is no such designated authority like T&TA in the Indian held Kashmir, however, the Deputy-Commissioner of the concerning district along with the representatives of the different government departments supervises concerned trading points.

This trade was activated from two routes, Chakothi-Slamabad and Tetrinote-Poonch through trucks. It was also decided that instead of import and export, the terms “Trade Out” (items traded from Azad Kashmir to Jammu & Kashmir) and “Trade In” (items traded from Jammu & Kashmir to Azad Kashmir) will be used. “The main reason for using this terminology was to avoid the Indian plan to recognize LoC as an international border because imports and exports are always carried out across the international borders. So, at the same time we wanted to promote the trade between these two parts of Kashmir and maintain the status of LoC as conversion of LoC into an international border is against the Pakistan principal stand on Kashmir.”

Data Analysis

The data used in the present study has been obtained from the record of T&TA offices based in Muzaffarabad and Trade Facilitation Office in Chakothi and Tetrinote, respectively. The record from trade registers was converted into digital format with the help of a team of students of Institute of Kashmir Studies, University of Azad Jammu and Kashmir Muzaffarabad, which is now available with comprehensive details of each trading session, traded items, their quantity and prices in the official data base system of T&TA till January 2013.

Trade Volume

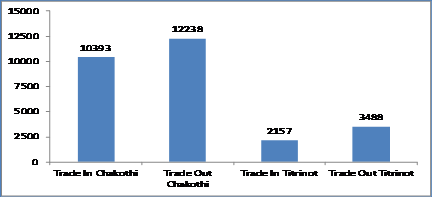

The total trade volume as per record of T&TA has been 28.276 Billion (PKR), out of which 15.72 Billion has been Traded Out and 12.550 has been the volume of goods Traded In since 2008, Therefore, the Trade Out is approximately 25% more than the Trade In. The Trade Out from Chakothi has been 12.238 Billion, whereas from Tetrinote, it was 3.488 Billion. The Trade In from Chakothi was 10.393 Billion, while from Tetrinote, it was 2.157 Billion. The trade Statistics is summarized in figure 1 below.

|

Fig. 1: Total Trade Volume (Million PKR), August 2008 to January 2013.

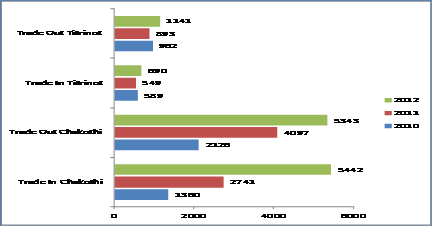

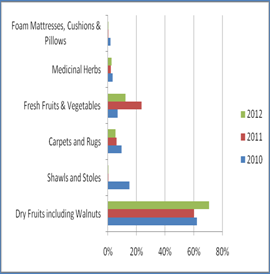

Figure 2 summarizes growth in trade for the period 2010-12. It can be observed that annual trade volume has shown tremendous growth despite many difficulties and hurdles. It is observed that the trade of certain goods was banned during this period; however, despite all these problems, the trade volume in 2010 was 5037 Million which increased to 12616 Million in 2012. Therefore, the annual trade volume was increased by 150%. However, the trade observed relatively slow growth from Tetrinote and the total increase in trade from this trade point was about 18%.

Fig. 2: Annual Trade Volume, (Million PKR), 2010-2012.

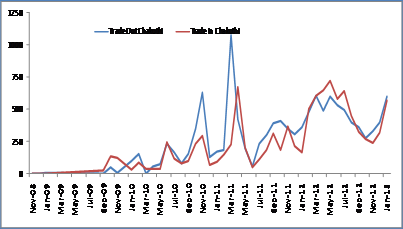

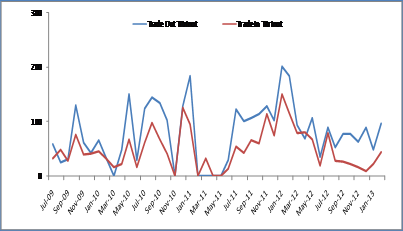

Trade Volatility

A time series plot of trade volume is given in figure 3. It can be noticed that the trade volume is volatile and changes a lot from month to month, for example, the trade out form Chakothi during March 2011 was over 1 Billion PKR but in June 2011, it was less than 100 Million. The trade from Tetrinote was also volatile and monthly trade volume changes a lot.

The volatility is directly linked with the political scenarios and relationship between India and Pakistan. Whenever political and diplomatic relationships between two nations become tense, it affects the cross LoC trade adversely. However, in the pleasant atmosphere, trade volume rises as by the end of 2011, the news about granting India the status of “Most Favorite Nation” was the top story which lasted positive effect on trade volume.

Fig. 3:The Trade Volume (Million PKR): Time Series Graph.

Composition of Trade

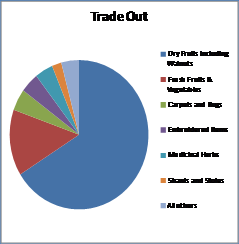

Table 1 summarizes value (million PKR) of different items traded out form the two trading points. The largest share in the trade out items corresponds to dry fruit which comprises 64% of the total trade from Chakothi and 71% of the total trade from Tetrinote. There are certain goods in the list of tradable items which were not traded practically, for example, there was no trade of precious stones, Gabbas, Namdas and black mushroom from Tetrinote.

Table 1: Share of Tradable Items in Actual Trade Out

|

Chakothi |

Tetrinote |

Total |

|||

|

Volume (million PKR) |

%age |

Volume (million PKR) |

%age |

Volume (million PKR) |

%age |

Rice |

8.05 |

0.07% |

17.25 |

0.49% |

25.30 |

0.16% |

Ja-e-NamazTusbies |

81.99 |

0.67% |

0.99 |

0.03% |

82.97 |

0.53% |

Precious Stones |

7.45 |

0.06% |

0.00 |

0.00% |

7.45 |

0.05% |

Gabbas |

0.00 |

0.00% |

0.00 |

0.00% |

0.00 |

0.00% |

Namdas |

0.00 |

0.00% |

0.00 |

0.00% |

0.00 |

0.00% |

Peshawari Leather |

12.63 |

0.10% |

9.55 |

0.27% |

22.18 |

0.14% |

Medicinal Herbs |

324.79 |

2.65% |

338.16 |

9.70% |

662.96 |

4.22% |

Maize & Maize Products |

0.63 |

0.01% |

0.60 |

0.02% |

1.23 |

0.01% |

Fresh Fruits & Vegetables |

1964.06 |

16.05% |

292.26 |

8.38% |

2256.32 |

14.35% |

Dry Fruits including |

7903.04 |

64.58% |

2488.87 |

71.36% |

10391.91 |

66.08% |

Honey |

160.45 |

1.31% |

0.00 |

0.00% |

160.45 |

1.02% |

Mungi |

1.76 |

0.01% |

287.80 |

8.25% |

289.56 |

1.84% |

Imli |

0.00 |

0.00% |

1.71 |

0.05% |

1.71 |

0.01% |

Black Mashrooms |

2.10 |

0.02% |

0.00 |

0.00% |

2.10 |

0.01% |

Furniture Including |

1.26 |

0.01% |

0.41 |

0.01% |

1.67 |

0.01% |

Wooden Handicrafts |

0.31 |

0.00% |

0.00 |

0.00% |

0.31 |

0.00% |

Carpets and Rugs |

736.41 |

6.02% |

0.39 |

0.01% |

736.80 |

4.69% |

Wall Hangings |

8.02 |

0.07% |

0.00 |

0.00% |

8.02 |

0.05% |

Embroidered Items |

631.22 |

5.16% |

46.17 |

1.32% |

677.39 |

4.31% |

Foam Mattresses, |

48.43 |

0.40% |

0.23 |

0.01% |

48.66 |

0.31% |

Shawls and Stoles |

345.18 |

2.82% |

3.58 |

0.10% |

348.75 |

2.22% |

|

12237.78 |

100% |

3487.98 |

100% |

15725.76 |

100% |

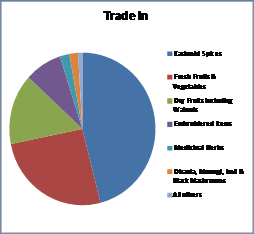

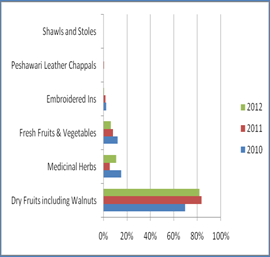

Table 2 summarizes the share of different items in the items traded from J&K to AK. The largest share in the trade in items is of Kashmiri spices (54%), followed by fresh fruits (21%) and dry fruits (11%). This implies that most of the trade from both sides of LoC consists of fresh and dry fruits and spices. Total trade of fresh and dry fruits and spices is about PKR 23540 Million which is 83% of the total trade.

Table 2: Share of Tradable Items in Actual Trade In

Trade In |

Chakothi |

Tetrinote |

Total |

|||

|

Volume (million |

%age |

Volume (million PKR) |

%age |

Volume (million PKR) |

%age |

Carpets |

0.26 |

0.00% |

0.01 |

0.00% |

0.28 |

0.00% |

Rugs |

0.23 |

0.00% |

0.10 |

0.00% |

0.33 |

0.00% |

Wall Wangings |

0.20 |

0.00% |

0.00 |

0.00% |

0.20 |

0.00% |

Shawls and Stoles |

7.87 |

0.08% |

4.25 |

0.20% |

12.13 |

0.10% |

Namdas |

0.05 |

0.00% |

0.00 |

0.00% |

0.05 |

0.00% |

Gabbas |

0.00 |

0.00% |

0.00 |

0.00% |

0.00 |

0.00% |

Embroidered Items |

953.41 |

9.17% |

78.54 |

3.64% |

1031.96 |

8.22% |

Furniture Including Walnut Furniture |

0.86 |

0.01% |

0.00 |

0.00% |

0.86 |

0.01% |

Wooden Handicrafts |

0.02 |

0.00% |

0.00 |

0.00% |

0.02 |

0.00% |

Fresh Fruits & Vegetables |

2223.88 |

21.40% |

1014.02 |

47.01% |

3237.90 |

25.80% |

Dry Fruits including Walnuts |

1181.80 |

11.37% |

698.01 |

32.36% |

1879.81 |

14.98% |

Saffron |

2.13 |

0.02% |

0.00 |

0.00% |

2.13 |

0.02% |

Aromatic Plants |

14.57 |

0.14% |

0.20 |

0.01% |

14.77 |

0.12% |

Fruits Baring Plants |

0.00 |

0.00% |

0.00 |

0.00% |

0.00 |

0.00% |

Dhania, Moongi, Imli& Black Mashrooms |

173.49 |

1.67% |

65.07 |

3.02% |

238.56 |

1.90% |

Kashmiri Spices |

5568.74 |

53.58% |

206.70 |

9.58% |

5775.44 |

46.02% |

Rajmah |

48.94 |

0.47% |

22.23 |

1.03% |

71.17 |

0.57% |

Honey |

0.34 |

0.00% |

0.15 |

0.01% |

0.49 |

0.00% |

Paper Mache Products |

18.84 |

0.18% |

0.00 |

0.00% |

18.84 |

0.15% |

Mattresses, Cushions, Pillows & Quilts |

0.48 |

0.00% |

0.00 |

0.00% |

0.48 |

0.00% |

Medicinal Herbs |

196.63 |

1.89% |

67.85 |

3.15% |

264.48 |

2.11% |

|

10392.74 |

100% |

2157.13 |

100% |

12549.87 |

100% |

The trade statistics reflect that the actual trade is taking place only in few items and most of the items in tradable list are not traded across LoC. The items with largest share in trade are summarized in tables 3 and 4.

Table 3: Top 6 Trade Out Items

Trade Out |

Chakothi |

Tetrinote |

Total |

|||

|

Volume (million PKR) |

%age |

Volume (million PKR) |

%age |

Volume (million PKR) |

%age |

Dry Fruits including Walnuts |

7903.0 |

64.58% |

2488.8 |

71.36% |

10391.9 |

66.08% |

Fresh Fruits & Vegetables |

1964.0 |

16.05% |

292.2 |

8.38% |

2256.3 |

14.35% |

Carpets and Rugs |

736.4 |

6.02% |

0.3 |

0.01% |

736.8 |

4.69% |

Embroidered Items |

631.2 |

5.16% |

46.1 |

1.32% |

677.3 |

4.31% |

Medicinal Herbs |

324.7 |

2.65% |

338.1 |

9.70% |

662.9 |

4.22% |

Shawls and Stoles |

345.1 |

2.82% |

3.5 |

0.10% |

348.7 |

2.22% |

All others |

333.0 |

2.72% |

318.5 |

9.13% |

651.6 |

4.14% |

Table 3 lists 6 items which formulate more than 95% of the total trade. Similarly, table 4 summarizes the goods Traded In which comprise more than 99% of the total trade.

Table 4: Top 6 Trade In items

Trade In |

Chakothi |

Tetrinote |

Total |

|||

|

Volume (million PKR) |

%age |

Volume (million PKR) |

%age |

Volume (million PKR) |

%age |

Kashmiri Spices |

5568.74 |

53.58% |

206.70 |

9.58% |

5775.44 |

46.02% |

Fresh Fruits & Vegetables |

2223.88 |

21.40% |

1014.02 |

47.01% |

3237.90 |

25.80% |

Dry Fruits including Walnuts |

1181.80 |

11.37% |

698.01 |

32.36% |

1879.81 |

14.98% |

Embroidered Items |

953.41 |

9.17% |

78.54 |

3.64% |

1031.96 |

8.22% |

Medicinal Herbs |

196.63 |

1.89% |

67.85 |

3.15% |

264.48 |

2.11% |

Dhania, Moongi, Imli & Black Mashrooms |

173.49 |

1.67% |

65.07 |

3.02% |

238.56 |

1.90% |

All others |

94.78 |

0.91% |

26.94 |

1.25% |

121.73 |

0.97% |

The trade statistics reveals that the actual trade is taking place only in few items, while there is a need to reconnoiter the potentials of auxiliary trade items on both sides of LoC and the list of tradable items needs to be stretched accordingly.

One of the explanations of limited number of traded goods is the lack of access to each others’ markets. Therefore, the existing Cross LoC trade is a blind trade in its nature as the traders are unable to observe the samples of goods that they are trading. Conceivably, due to this reason, the range of traded items has been reducing day by day and the trade is concerted only in few items. The share of dry fruits in trade out items was about 62% in 2010 which increased to 72% in 2012.

Fig. 4: Composition of Trade Items.

The above mentioned tables depict that the least traded commodities in 2010 have further declined in the following years and the trade concentrated more on limited items.

TRADE OUT

TRADE IN

Fig. 5: Composition of Trade over Time, Chakothi.

Table 5: Share of Top 6 Items in Total Volume of Trade

|

Trade Out Chakothi |

Trade Out Tetrinote |

Trade In Chakothi |

Trade In Tetrinote |

2010 |

96.46% |

99.74% |

98.53% |

98.62% |

2011 |

96.52% |

99.91% |

96.69% |

96.40% |

2012 |

98.68% |

99.85% |

98.04% |

96.55% |

Table 5 shows share of top 6 items in the total volume of trade. It can be noticed that the share of top 6 items in trade out from Chakothi was 96.46% in 2010 which increased to 99% in 2012. This shows that the trade is becoming more concentrated around few items and the diversity of trade is reducing.

The Complexity of Cross LoC Trade

Issues relating to the origin and destination of the goods have made this trade very complex as the two countries have the authority to remove any item from the tradable items. For instance, the J&K authority has banned the Trade Out of Ajvane from AK to J&K because it was counted as part of spices, not as herbals; while spices are enlisted in “trade in” items. Ginger was banned because it was imported from China to Pakistan and “traded out” to J&K.

Pakistan banned Daal Moongi (Green Gram) in 2011. Authority claimed that the decision was taken due to the shortage of Green Gram as it is a settled principle that in case of scarcity in any item, its trade would be suspended partially and when the production gets normal, its trade would be re-continued. On the other hand, traders do not accept the official explanation because Green Gram is available in a large quantity in Pakistan but its trade has not yet been started. Commenting on the issue, the Director General (DG) Trade and Travel Authority (T&TA) said: “Though Daal Moongi is a profitable item, yet any item that included in the trade list would be banned if its price goes up by 25 percent. These days, the price of Green Gram has gone very high from Rs. 15 to Rs. 120 per kilogram (price slogged by almost 800 %).”

The traders once again rejected the statement and tried to justify their stance that the position of the goalpost can’t be changed once the match is started. “We have already Traded In the products from J&K to AK against Trading Out the Green Gram but due to the ban on Green Gram from authorities, we will have to suffer as Green Gram has been a highly

profitable business (about 12% of the total trade) since its inception.” Similarly, Pakistan Government has imposed a ban on banana and coconut, which are profitable items for traders; however, traders alleged that Government has issued the order only to save the local trader in big cities like Karachi and Lahore. Officials in Muzaffarabad claimed that Indian authorities have also banned some of the trading items in the list like dates and Almond (Badaam). It looks like a culture of ‘tit for tat’is dominant but it affects traders a lot.

Barter Trade System

The trade across LoC is allowed on barter system which is a reciprocal exchange of goods without involving currency. The barter system is a formidable type of trade which requires double co-incidence of wants for trade. Barter trade dealings can grow only when two traders across the LoC exchange the goods which are profitable on each other’s sides. However, due to the absence of common measure of value, the cross LoC barter system is facing many hurdles. Particularly, in the monetary economy, money plays its role in measuring the value of all goods while this role is absent in a barter economy, however, its negative impact can be curtailed if the traders have the opportunities to visit each other’s markets. Therefore, it is hard to assess and gauge the weight, quality and prices of the item and there is no guarantee of equal return and recovery of discrepancy amount from counterparts across the LoC, which is a big snag in this kind of trade.

Commenting on the nature of LoC trade, Syed Javed Hussain Gillani said: “the barter system is double blind in a sense that the traders are not able to review the sample of goods that they are trading nor they have the opportunity of direct interaction to settle the disputes and decide good comparison of their own requirement.” Similarly, Mubarrak Mahmood Awan holds that “if we trade out one truck from AK, it could be profitable for us. However, it is possible that in return, the items coming from across the LoC (trade in) would be non-beneficial for us and we would face inconvenience in it as the prices of some specific items could be less here.

This kind of business can only be successful if a person in Azad Kashmir has close relatives in Jammu & Kashmir and both the relatives agree to trade goods for each other and then it will be beneficial for both parties. People are of the view that the relatives are trusted in this kind of trade; otherwise, it is a big risk to put a big amount of money in a blind way. Due to the absence of trusted partner on either side of Kashmir, it makes a clear sense that the new people are unable to step into the cross LoC trade.

Non-existence of Appropriate Communication

One of the prime impediments in the trade across the LoC is the lack of proper communication between traders. They do not have opportunities of meeting with each other except in the meetings at the trade crossing points and even they are not allowed to share the sample of products they are trading. Therefore, it is very challenging to decide which item should be bought or sold. Traders are fully dependent on their counterparts across LoC. In Azad Kashmir side, there is a telephone facility available to the AK traders to contact their counterparts on the other side of the LoC, however, there is no such direct facility provided to the traders on the Indian authorities. So, the traders of J&K have to make their business deal through their agent based in Delhi.

Traders from both sides of LoC conduct monthly meetings at crossing points. The main purpose of these types of meetings is to settle the traders’ payment issues and complications regarding the trade/trade-items. These meetings are held once a month on agreed date and time arranged by both designated authorities. These meetings at crossing points from both sides are conducted under the supervision of Trade Facilitation Officer (TFO) in coordination with Army, Intelligence Agencies, Police officers and traders. However, traders are not allowed to get involved in any kind of agreement/Memorandum of Understanding (MoU) regarding the cross LoC trade.

Lack of role of Financial Intermediaries

Currently, the financial intermediaries like banks play a vital role in the international trade. The banks facilitate trade system by the letter of credit which insures the trading partner for payment of his subscriptions as in the absence of direct approach to each other’s market. Traders need a trustable trade partner on the other side of the LoC which is itself very challenging task. There is a heavy risk of default and non-payment in this barter system. If a merchant from one side of LoC sends goods for his counterpart on the other side of LoC and if after receiving goods, his counterpart escapes or does not confer him imbursement, there is no system of its return. In fact, there are number of such complaints in this direction.

Despite invoices, authorities from both the sides do not help in the return of payment as both the governments could not develop any mechanism to deal with payment issues. It is almost impossible to get the money reimbursement if the trade partner on other side of LoC declines to pay. In some cases, the J&K based traders in Pakistan also suffer as Dr. Wali Rasool (Rawalpindi-Islamabad based intra-Kashmiri trader) elucidates that the blind trade is very serious jeopardy for the J&K-based traders who moved to Pakistan after the 1988. About 90 percent of them had been involved with Kashmir movement and they have no system to re-enter into Kashmir to clear their business disputes if their business partners escape. However, the LoC traders from Azad Kashmir and J&K have the prospect to approach their business partners on either the side of the LoC by getting the visa if the need arises. However, this is not an easy business.

In practice, there is no legal cover or support provided to the cross LoC traders and there is no legal framework available to deal with these disputes. This is because cross LoC trade is not considered as international trade; rather, it is just a part of Confidence Building Measures (CBMs) in which both the governments have to maintain the status of LoC and continuation of trade at the same time. Mian Khalid Rafiq, the President of Chamber of Commerce Mirpur, says that it is a blind trade which involves several threats. Actually, Intra-Kashmir Trade was established to develop tranquility and linkages between people of two sides of divided Kashmir, but as a result of cynicism in trade, it is slowly going to transform into antipathy. If it is a part of CBMs, then there are very little probabilities of its success as it is interconnected with the Kashmir Conflict.

The role of Joint Chamber of Commerce (JCC) becomes important as JCC can fill this gap by mounting pressure on the Indian and Pakistani governments to allow banks to open branches in all the main cities across the LoC. It is also imperative that JCC should organize seminars on the importance of cross LoC trade in all the main cities including Srinagar, Jammu, Ladakh, Poonch, Mirpur, Muzaffarabad, Rawalakot, Hajira and Kotli on quarterly basis.

Taxation Structure

Under the agreement between India and Pakistan, it is zero tariff trade, however, T&TA in consultation with AK traders, charges Rs. 3000.00 (three thousand) per truck (one-sided) as handling charges and Rs. 500.00 (Five hundred) as Quarantine charges at Tetrinote (Rawalakot-Poonch) and Chakothi (Chakothi-Salamabad) trading points, respectively. All this money collected from traders goes to the T&TA account. On top of these charges, district administration charges Rs. 500.00 (five hundred) on each truck as district tax. Traders claim that there is no reason for charging the district tax as it increases the cost of items.

It is an illegal activity as under the agreement, it is zero tariff trade and traders are reluctant to pay this extra payment as Mubarak Awan cries, “we pay all this money without any receipt, which is like a jagga tax (forced money)”. T&TA condemned it as it is the traders who do not collect the receipt. Syed Ejaz Shah revealed that the Kashmiri traders on the other side of the LoC pay just Rs. 2000.00 per truck and the J&K Government is taking special interest and are committed to stimulate the intra-Kashmir trade as it has reserved Rs. 200 million for the construction of terminal on trading point. DG T&TA expressed that prior to the institution of T&TA (4th March 2009), Government of Pakistan had allocated about Rs. 200 million for the improvement of basic infrastructure, however, this money was not spent on the factual purpose.

Role of Trade and Travel Authority

The Trade and Travel Authority (T&TA) was established hypothetical to expedite the trade between two parts of divided Kashmir, however, many businessmen consider it as one of the main hurdles in this trade. Officers of T&TA allot numbers to the traders or list them. Sardar Kazim Khan claimed that “in order to make this trade successful, local traders send the vehicles on their own and continue trade even sometimes at very confrontational trade season but when profitable business starts, the officers of T&TA send new and unknown people (usually their own preferred individuals) to the crossing points with their names on top of the list and the local traders could scarcely catch themselves on the bottom part of the list, which is very disheartening for us.” Approximately 100 traders are concomitant with Titrinote LoC trading point but sometimes 200 traders reach the crossing points, most of them are unknown to the native traders. Javed Iqbal Bhatti disclosed that out of around 1200 registered traders, only about 100 traders are active in LoC trade.

Mahmood Akhtar Kakur grumbled that approximately 80 percent Pakistani and Indian traders are related with this trade through their proxies and there is a need to discourage these commission agents. It is pragmatic that these transitory or seasonal traders are favorites of T&TA officers who are the recipients of this trade. T&TA officials have declined all the allegations and articulated that in cross LoC trade, issuance of “list of traders” is on the basis of merit. However, it has been reported that in some cases, most of the proxy traders sell their priority numbers to other traders against reasonable money. Therefore, contamination in the system of T&TA is an immense problem for the traders associated with LoC trade. Consequently, traders call on strikes for their rights which results in the snarl-up of trade, causing another detriment to the local traders. Mahmood Ahmed Dar endorsed that “we had to face the cases under anti-terrorist activities when we called on the strike against the orders of former chief secretary of Azad Kashmir.” Dr. Wali Rasool also criticizes the role of T&TA as LoC trade agreement assigns responsibility to Trade and Travel Authority (T&TA) to improve the existing standard policies and procedures and formulate a new mode for the settlement of claims and disputes between the traders and take steps to improve the ongoing trade & travel, however, it could not achieve its objective yet.

Trade Vulnerability

The cross LoC trade is very fragile in its nature as it is directly interrelated with the Indo-Pak seriousness towards peace. Incidence in any part of the region cause stoppage of the trade as it happened on 17th of January 2014 in which Indian authorities arrested a truck driver carrying goods as part of 50 trucks convoy from Chikothi (AK) to Salamabad (J&K), which caused the suspension of all cross-LoC trade and bus services for at least two weeks. The J&K authorities alleged that the driver was carrying some narcotics while in a counter reaction, Azad Kashmir Government has also held 27 Indian truck drivers carrying trade consignment and demanded release of their arrested driver. It seems to be a part of mistrust as both the parties alleged each other for using the negative tactics in mounting barriers in cross LoC trade.

Lack of Access to Markets

There is no local market and dry port in Azad Kashmir. Therefore, goods reach Pakistani markets through Azad Kashmir and then after repacking, these items once again reach the cities in Azad Kashmir, making the goods expansive and not expedient for the local people in Azad Kashmir. This is one of the reasons that common population is not much enthusiastic in this trade.

Opportunities

The direct interaction between the members of civil societies across the LoC through trade and travel can play an affective role as part of confidence building measures between India & Pakistan. Kashmir issue has a political dimension and as such needs a political settlement. The main difficulty with regard to resolving the conflict in Kashmir lies not in the stakes involved but in the patterns of attitude and behavior that have developed over six decades. With the opening of all the historic routes including Mirpur-Naushara, Tithwal-Chilhan, Gurez-Astore-Gilgit, Chumb-Pallanwalla, Kargil-Skardu and Kotli-Rajori, the people to people contact will improve the economic and peaceful atmosphere of the region as it has been noticed that the intensity of the militancy in Kashmir declined since its inception. The involvement of sizeable number of people who have been actively participating in the Kashmir movement since 1988 is a positive gesture towards the peace efforts by diverting their attention towards the economic activities.

The economic phase of relationship will have a political impact on both the countries as we have a model of Sino-Indian relationship where despite the war of 1962 and border tension, the size of bilateral trade has been growing and neither side wants conflict since its initiation. The economic activity across the LoC and between India and Pakistan and beyond will develop the concept of Commonwealth of SAARC economic market on the pattern of Euro Union. Secondly, hassle free trade will evolve economic complementarities and will help in the development of comparative advantage between the two parts of erstwhile state of Jammu and Kashmir. As a result, cost of production will stay at lower level for the larger benefit of people in the region. Thirdly, the soft and hard infrastructure and communication between different parts of the State will be developed swiftly which would be helpful in exploring and utilizing the natural resources of the region.

Conclusion

The trade and travel across LoC has re-opened the venues for interaction and mutual understanding, that is why, the trade is welcomed by the Kashmiris more than expectations. It can be analyzed from the trade statistics that despite all types of bottle-necks, the trade volume is showing consistent growth and if the restrictions on trade are reduced, the trade volume may increase manifold. The economic and peace-building potential of the cross LoC trade cannot be overstated. Particularly, the people to people collaboration between the divided families and the involvement of civil society in trade activities will certainly create hallucinogenic force against hostile mindset prevailing in South Asian region as Kashmir conflict has affected implausible human and economic costs. The new approach in Indo-Pak relations has provided an opportunity to the policy makers to revisit their policies and to use cross LoC trade as a mean of reconciliation. There is a growing optimism that the greater economic interdependence would act as a facilitator for enhancing the conflict by creating a durable, indigenous constituency that can drive the two neighboring countries toward the peaceful resolution of the conflict.

Bibliography

Ali, S., [2012]: Cross LoC Trade-Success Against All Odds, Mercy Corps Pakistan, Islamabad.

Bharadwaj, P, C., [2009]: Kashmir State of Militancy–Northern Command Appraisal, Security Trends South Asia, Delhi.

Dixit. J. N., [2002]: India-Pakistan in War and Peace, Routledge Publishers, New York.

Rehman. F., and Amna, A., [2013]: AJ&K Standard Operating Procedures for Cross LoC Trade, Mercy Corps Pakistan, P. 2.

Personal interview with Khawaja Abdul Samad Shad, Cross LoC Trader, Muzaffarabad, 16th September 2012.

Personal interview with Brigadier (R), Mohammed Ismael, Director General, T&TA, Muzaffarabad, 31st December 2012.

Personal interview with Sardar Kazim Khan, Member T&TA Management Board: MaaJee Traders, Hajira, 3rd November 2012.

Personal interview with Sardar Azeem Khan, Cross LoC Trader, Midarpur Hajira, 3rd November 2012.

Personal interview with Syed Javed Hussain Gillani, Cross LoC Trader, Muzaffarabad, 16th September 2012.

Personal interview with Mubarrak Mahmood Awan, Cross LoC Trader: Pak Kashmir Traders, Muzaffarabad, 16th September 2012.

Personal interview with Kashan Masood, President LoC Trade Council: Al Masood Traders, Hajira, 3rd November 2012.

Personal interview with Shakoor Hussain, Assistant Director T&TA, Muzaffarabad, 28th March 2013.

Personal interview with Syed Ejaz Shah, Cross LoC Trader, Al-Syed Enterprises, Islamabad, 9th November 2012.

Personal interview with Dr. Wali Rasool, Cross LoC Trader, Business Hub, Islamabad, 9th November 2012.

Personal interview with Mian Khalid Rafiq, the President of Chamber of Commerce, Mirpur, 11th January 2013.

Personal interview with Kashan Masood, President LoC Trade Council: Al Masood Traders, Hajira, 3rd November 2012.

Personal interview with Mubarrak Mahmood Awan, Cross LoC Trader: Pak Kashmir Traders, Muzaffarabad, 16th September 2012.

Personal interview with Syed Ejaz Shah, Cross LoC Trader, Al-Syed Enterprises, Islamabad, 9th November 2012.

Personal interview with Javed Iqbal Bhatti, Cross LoC Trader, Chinar Enterprises, Islamabad, 9th November 2012.

Personal interview with Mahmood Akhtar Kakur, Cross LoC Trader, Mahmood Enterprises, Islamabad, 9th November 2012.

Personal interview with Shafiq Chaudhry, the President of Chamber of Commerce, Kotli, 11th January 2013.

Personal interview with Asad Mubarak, Cross LoC Trader: Abdullah Traders, Midarpur Hajira, 3rd November 2012.

Personal interview with Mahmood Ahmed Dar, Cross LoC Trader, Mahmood Trading Corporation, Islamabad, 9th November 2012.

Personal interview with Sardar Azeem Khan, Cross LoC Trader, Midarpur Hajira, 3rd November 2012.

Personal interview with Mahmood Bilal, Member of civil Society, Muzaffarabad, 9th November 2012.

Personal interview with Jusrtice (R) Javed Iqbal., Muzaffarabad, 10th November 2013.

Personal interview with Dr. Atiqur Rehman, Assistant Professor, International Islamic University Islamabad, Islamabad, 12th December 2012.

Newspapers/Journals/Circulars

Government of Pakistan Agreed Outcomes of the Meeting of Joint Working Group on Cross LoC CBMs, New Delhi, 22nd September 2008.

AJ&K Cross LoC Travel and Trade Authority Ordinance V of 2009, No. LD/Legis./198-213/2009, (4th March 2009).

Indian Home Affairs Ministry issued new SOPs via circular No.13015/01/2011-K. III, 4th July 2012.

Standing Operating Procedure for Traders, (AJ&K Cross LoC Travel and Trade Authority, 18th February 2013.

Daily Dharti, Rawalakot, 29th January 2014.

It is usually bilateral but may be multilateral (as sometimes trade mediated through barter organizations) and usually exists parallel to monetary systems in most developed countries, particularly when the currency may be either unstable.

Personal interview with Syed Javed Hussain Gillani, Cross LoC Trader, Muzaffarabad, 16th September 2012.

Personal interview with Mubarrak Mahmood Awan, Cross LoC Trader: Pak Kashmir Traders, Muzaffarabad, 16thSeptember 2012.

Personal interview with Kashan Masood, President LoC Trade Council: Al Masood Traders, Hajira, 3rd November 2012.

Personal interview with Syed Ejaz Shah, Cross LoC Trader, Al-Syed Enterprises, Islamabad, 9th November 2012

Personal interview with Dr. Wali Rasool, Cross LOC Trader, Business Hub, Islamabad, 9th November 2012

Personal interview with Mian Khalid Rafiq, the President of Chamber of Commerce, Mirpur, 11th January 2013

Personal interview with Kashan Masood, President LoC Trade Council: Al Masood Traders, Hajira, 3rd November 2012

Personal interview with Mubarrak Mahmood Awan, Cross LoC Trader: Pak Kashmir Traders, Muzaffarabad, 16th September 2012

Personal interview with Syed Ejaz Shah, Cross LoC Trader, Al-Syed Enterprises, Islamabad, 9th November 2012

Personal interview with Javed Iqbal Bhatti, Cross LoC Trader, Chinar Enterprises, Islamabad, 9th November 2012

Personal interview with Mahmood Akhtar Kakur, Cross LoC Trader, Mahmood Enterprises, Islamabad, 9th November 2012

Personal interview with Shafiq Chaudhry, the President of Chamber of Commerce, Kotli, 11th January 2013

Personal interview with Asad Mubarak, Cross LoC Trader: Abdullah Traders, Midarpur Hajira, 3rd November 2012

Personal interview with Mahmood Ahmed Dar, Cross LoC Trader, Mahmood Trading Corporation, Islamabad, 9th November 2012

Bharadwaj, P, C., Kashmir State of Militancy – Northern Command Appraisal, Security Trends South Asia, 2009, Delhi

* Director, Institute of Kashmir Studies, University of AJ&K Muzaffarabad.

** Assistant Prof. Department of Public Administration, University of Karachi.

The 740 kilometers long Line of Control (LoC) divides the two parts of former princely State of Jammu & Kashmir (Azad Jammu & Kashmir, Gilgit-Balitstan under Pakistani control and Jammu & Kashmir under Indian control). Originally known as the Cease-fire Line which was established in 1949, however, it was re-designed with some changes as the Line of Control under the Simla Agreement in 1972.

During the United Nations General Assembly session in New York in September 2008, Pakistani President Asif Ali Zardari and Indian Prime Minister Manmohan Singh agreed (in a sideline meeting) to implement the previously reached understanding to allow trade across the LoC.

It was the part of General Musharraf formula as a solution to the Kashmir conflict who moved it later in 2006:

- Self-governance or autonomy not independence, (b) Demilitarization from the region in a phased manner (if violence goes, peace returns), (C) Irrelevant borders (means free movement of people across the LoC and trade between India and Pakistan and between the two parts of Kashmir), (D) Joint management of Kashmir (comprising representatives from India, Pakistan and both parts of Kashmir to supervise the common interests like trade, tourism, and river waters etc.

The list includes carpets, rugs, wall hangings, shawls and stoles, namdas, gabbas, embroidered items, furniture, wooden handicrafts, fresh fruits, saffron, aromatic plants, fruit bearing plants, black mushrooms, Kashmiri spices, rajmah, honey, paper machie products, foam mattresses, cushions/pillows and quilts, and medicinal herbs.

Personal interview with Khawaja Abdul Samad Shad, Cross LoC Trader, Muzaffarabad, 16th September 2012.

On 4th July 2012, the Indian Home Affairs Ministry issued new SOPs via circular No.13015/01/2011-K.III, to elucidate these bans. According to clause (a) of the new guidelines: “The Agreed List of items of trade would be respected by all the authorities handling cross LoC trade. All those items, listed in the Agreed List would be allowed to be traded subject to the condition that products of third country origin would not be allowed to be traded.” Available on: http://kashmirlife.net/trans-loc-trade-the-new-sop/

The term AK will be used for Azad Jammu and Kashmir under Pakistani administration while J&K will be used for Indian administration part of Kashmir.

Rehman. F., and Amna, A., AJ&KStandard Operating Procedures for Cross LoC Trade, Mercy Corps Pakistan, Islamabad 2013, p. 2.

AJ&K Cross LoC Travel and Trade Authority Ordinance V of 2009,No. LD/Legis./198-213/2009, 4th March 2009.