DYNAMICS OF INTRA-INDUSTRY SPECIALIZATION BETWEEN PAK-CHINA TRADE

Shafaqat Mehmood* and Ather Azim Khan**

Abstract

We have analyzed the factor adjustment problems that may be experienced by China and Pakistan, due to trade openness resulting from Free Trade Agreement (FTA). Variations in indicators (i.e. total trade, net trade, intra-industry trade, Grubel-Lloyd index and trade ratio) have been used to achieve the research objectives. Our estimates captured a small number of industries, which encountered adjustment problems. Therefore, our findings facilitate the regulatory authorities to implement controls on tariffs and rates to enhance imports and exports from their sensitive sectors, in order to improve economic growth and best use of FTA.

Introduction

Free Trade Agreement (FTA) leads to boost production, trade, and investment among member countries, and ultimately to enhance economic growth. Trade agreement based trade flows among countries can be divided into two major parts namely: Inter-Industry Trade (IT) and Intra-Industry Trade (IIT). IT is exchange of entirely different commodities between economies. Countries usually involve in IT according to their competitive advantages.

Pakistan and china have strong positive trade relations. These two countries are contiguous and the common border plays workhouse role to promote trade relations. On November 24, 2006, these two countries signed China-Pakistan Free Trade Agreement (CPFTA) and this agreement was then enforced in July 2007. The purpose of CPFTA was to strengthen their relationship, eliminate trade barriers, and promote trade and investment contracts, to generate economic growth. CPFTA was expected to boost the volume of current bilateral trade between Pakistan and China to three times within a time span of five years. CPFTA covered expropriation, investment and its treatment, promotion and protection, dispute settlement, and compensation for damages or losses.

CPFTA was signed by the ministers for commerce of Pakistan and China (i.e. Humayun Akhtar Khan and Bo Xilai) in the presence of Pakistani President Pervez Musharraf and Chinese President Hu Jintao. An agreement of Early Harvest Program (EHP) was also negotiated by these two countries to provide the basis for establishing CPFTA. It was decided under CPFTA that, Pakistan and China will start eliminating or decreasing tariffs on all commodities in two separate phases.

The first phase of decreasing tariffs was started in 2006, followed by the second phase two years later. The lists of items at that time contained products such as fruits, blended and synthetic fabrics, home textiles, marble tiles, sports goods, chemical raw materials, surgical goods, medicines and industrial machinery among others. These lists were to be expanded later on to cover additional goods. It was also decided that during Phase I, both countries will trim down the tariffs to 85 percent within five years after enforcement of CPFTA. Furthermore, it was decided that tariffs will be eliminated on 36 percent of products within three years of enforcement of CPFTA. During the first phase, China decreased tariffs on vegetables, livestock, textiles, aquatic products, and mineral products, while Pakistan decreased tariffs on chemicals, beef and mutton, and machinery products.

Phase II of CPFTA was started after completion of the first five years of the agreement and it was decided that both countries will further decrease tariffs on commodities based on review of realization of agreement. The purpose was to remove tariffs on products up to 90 percent, both in terms of trade volume and tariff lines during a reasonable time period subject to friendly accommodation and consultation.

Economic integration creates a heavy amount of economic adjustment for each country. Economic adjustment costs are very high among countries. But within industries, economic integration is very valuable and resolves the problem of specialization within industries. Economic integration is even more valuable when it facilitates economies to realize superior specialization within a similar industry. IIT represents a two-way trade in commodities having same industry classification. At this juncture, productive factors change with negligible internal trouble between sections of same industry. Therefore, producers are able to understand efficient scale processes based on this pattern of specialization. Consumers benefit from low prices and superior varieties of commodities. FTA accelerates trade growth both in IT and IIT. It is usually conceived that FTA between developing and industrial countries will produce more IT as compared to IIT.

Objectives of the Study

This study is aimed at the following objectives:

- To empirically explore the factor adjustment problems that may be experienced by China and Pakistan due to trade openness resulting from CPFTA

- To find the specialized sectors that came across the factor adjustment problems based on the dynamics of intra-industry specialized indicators

Data and Empirical Methodology

Our analysis covers the period from 2004 to 2014 and uses two digit sectors level data on exports and imports of China and Pakistan. Data were gathered from UNCOMTRADE database according to two digit level of Standard International Trade Classification (SITC) Revision two (see Table A.1).

Table A.1: Commodity Codes and Description at 2-digit Level Based on SITC

SITC |

Industry |

SITC |

Industry |

00 |

Live Animals |

56 |

Fertilizers |

01 |

Meat and Meat Preparations |

57 |

Plastics in Primary Form |

02 |

Dairy Products and Birds’ Eggs |

58 |

Plastics in Nonprimary Form |

03 |

Fish (Except Marine Mammal) |

59 |

Chemical Materials |

04 |

Cereals and Cereal Preparations |

61 |

Leather, Leather Mfr |

05 |

Vegetables and Fruit |

62 |

Rubber Manufactures |

06 |

Sugars, Sugar Preparations |

63 |

Cork and Wood Manufactures |

07 |

Coffee, Tea, Cocoa |

64 |

Paper, Paperboard |

08 |

Feeding Stuff for Animals |

65 |

Textile Yarn, Fabrics |

09 |

Miscellaneous Edibles |

66 |

Nonmetallic Mineral Manufactures |

11 |

Beverages |

67 |

Iron and Steel |

12 |

Tobacco and Tobacco Products |

68 |

Nonferrous Metals |

21 |

Hides, Skins and Furskins |

69 |

Manufactures of Metals |

22 |

Oil Seeds and Oleaginous Fruits |

71 |

Power Generating Machinery |

23 |

Crude Rubber |

72 |

Machinery Specialized |

24 |

Cork and Wood |

73 |

Metalworking Machinery |

25 |

Pulp and Waste Paper |

74 |

General Industrial Machinery |

26 |

Textile Fibers |

75 |

Office Machines and ADP Equipment |

27 |

Crude Fertilizers |

76 |

Telecommunications Equipment |

28 |

Metalliferous Ores |

77 |

Electrical Machinery, Appliances |

29 |

Crude Animal and Vegetable Mat |

78 |

Motor Vehicles |

32 |

Coal, Coke and Briquettes |

79 |

Transport Equipment |

33 |

Petroleum, Petroleum Products |

81 |

Prefab Buildings |

34 |

Gas, Natural and Manufactured |

82 |

Furniture and Bedding |

41 |

Animal Oils and Fats |

83 |

Travel Goods, Handbags |

42 |

Fixed Veg. Fats and Oils |

84 |

Articles of Apparel and Clothing |

43 |

Animal/Vegetable Fats/Oils |

85 |

Footwear |

51 |

Organic Chemicals |

87 |

Professional Scientific Instruments |

52 |

Inorganic Chemicals |

88 |

Photo Appt, Equipment, Optical Goods |

53 |

Dyeing, Tanning and Coloring Mat |

89 |

Miscellaneous Manufactured Articles |

54 |

Medicinal and Pharmaceutical Prod |

93 |

Special transactions |

Grubel-Lloyd (GL) index has been used to explore the intra-industry trade (Grubel and Lloyd,1975). GL index is the ratio of intra-industry trade and total trade, which analyzes the intra-industry share in total trade. The general form of this index is as under:

![]()

Where ![]() indicates exports of industry i and

indicates exports of industry i and ![]() indicates imports of industry i.

indicates imports of industry i. ![]() and

and ![]() indicate Net Trade (NT) and Total Trade (TT) respectively (

indicate Net Trade (NT) and Total Trade (TT) respectively (![]() and

and ![]() .). An index having zero value shows complete inter-industry trade, which promulgates that either the value of imports or exports is zero. Index having higher values shows a rise of share of intra-industry in the total trade, while an index having value of 1 shows the equality between imports and exports or complete IIT.

.). An index having zero value shows complete inter-industry trade, which promulgates that either the value of imports or exports is zero. Index having higher values shows a rise of share of intra-industry in the total trade, while an index having value of 1 shows the equality between imports and exports or complete IIT.

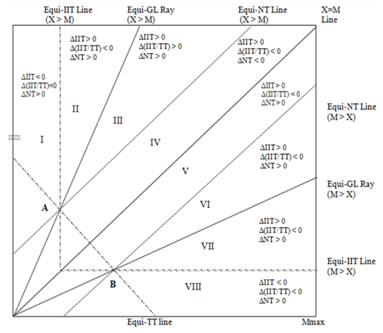

Following the empirical work of Azhar, Elliott, and Milner (1998), Industry Trade Box (ITB) is employed to assess the factor adjustment problems through examination of the dynamics of intra-industry specialization indicators over the period under consideration. Figure1 contains the industry trade box.

Figure A.1: Industry Trade Box

Source: Azhar et al. (1998)

Results and Discussions

Table A.2 contains results of GL index of trade between Pakistan and China. There is an increase in simple average of GL index over the period 2004-2014. GL indices indicate that in case of 37 industries, IIT has increased relative to the total trade, and decreased in case of 16 industries, thus the changes in general values of average GL index are not large. However, there is no change in GL index for remaining 8 industries.

Table A.2: Grubel-Lloyd (GL) Indexes for Trade between Pakistan and China

SITC |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

00 |

0 |

0 |

0 |

0 |

0 |

0 |

0.083 |

0.000 |

0.000 |

0.000 |

0.000 |

01 |

0.000 |

0.000 |

0.000 |

0.080 |

0.284 |

0.202 |

0.003 |

0.000 |

0.000 |

0.000 |

0.161 |

02 |

0.000 |

0.000 |

0.172 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

03 |

0.0001 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.002 |

0.005 |

0.002 |

04 |

0.170 |

0.296 |

0.749 |

0.397 |

0.126 |

0.578 |

0.268 |

0.965 |

0.486 |

0.121 |

0.243 |

05 |

0.043 |

0.012 |

0.021 |

0.020 |

0.101 |

0.020 |

0.026 |

0.014 |

0.040 |

0.072 |

0.105 |

06 |

0.001 |

0.386 |

0.897 |

0.032 |

0.011 |

0.001 |

0.003 |

0.000 |

0.277 |

0.000 |

0.022 |

07 |

0.457 |

0.002 |

0.017 |

0.032 |

0.002 |

0.000 |

0.001 |

0.000 |

0.005 |

0.000 |

0.000 |

08 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.519 |

0.003 |

0.525 |

0.974 |

0.472 |

09 |

0.246 |

0.824 |

0.271 |

0.172 |

0.005 |

0.093 |

0.143 |

0.000 |

0.115 |

0.196 |

0.000 |

11 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.732 |

0.000 |

0.000 |

0.005 |

12 |

0.000 |

0.000 |

0.000 |

0.000 |

0.668 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

21 |

0.000 |

0.052 |

0.000 |

0.338 |

0.895 |

0.487 |

0.000 |

0.366 |

0.758 |

0.856 |

0.018 |

22 |

0.523 |

0.000 |

0.243 |

0.907 |

0.921 |

0.402 |

0.721 |

0.435 |

0.574 |

0.719 |

0.745 |

24 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

25 |

0.000 |

0.000 |

0.142 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.035 |

0.256 |

0.000 |

26 |

0.097 |

0.109 |

0.663 |

0.783 |

0.459 |

0.595 |

0.764 |

0.231 |

0.131 |

0.502 |

0.617 |

27 |

0.496 |

0.406 |

0.204 |

0.914 |

0.653 |

0.460 |

0.704 |

0.828 |

0.741 |

0.515 |

0.306 |

28 |

0.167 |

0.242 |

0.447 |

0.237 |

0.121 |

0.054 |

0.052 |

0.019 |

0.011 |

0.051 |

0.026 |

29 |

0.339 |

0.380 |

0.000 |

0.411 |

0.588 |

0.903 |

0.694 |

0.843 |

0.785 |

0.743 |

0.709 |

32 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

33 |

0.488 |

0.010 |

0.628 |

0.000 |

0.000 |

0.775 |

0.000 |

0.000 |

0.000 |

0.012 |

0.535 |

34 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

41 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.651 |

42 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.008 |

0.000 |

0.000 |

0.012 |

0.002 |

43 |

0.000 |

0.904 |

0.000 |

0.000 |

0.057 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.136 |

51 |

0.764 |

0.959 |

0.753 |

0.681 |

0.059 |

0.658 |

0.271 |

0.105 |

0.025 |

0.124 |

0.041 |

52 |

0.000 |

0.000 |

0.025 |

0.000 |

0.003 |

0.005 |

0.000 |

0.001 |

0.000 |

0.000 |

0.003 |

53 |

0.0001 |

0.000 |

0.003 |

0.002 |

0.005 |

0.006 |

0.011 |

0.001 |

0.001 |

0.001 |

0.014 |

54 |

0.028 |

0.038 |

0.013 |

0.009 |

0.009 |

0.014 |

0.013 |

0.006 |

0.009 |

0.005 |

0.006 |

55 |

0.125 |

0.012 |

0.014 |

0.009 |

0.039 |

0.000 |

0.015 |

0.014 |

0.011 |

0.005 |

0.008 |

56 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

57 |

0.610 |

0.284 |

0.349 |

0.679 |

0.547 |

0.063 |

0.147 |

0.416 |

0.381 |

0.573 |

0.795 |

58 |

0.000 |

0.000 |

0.003 |

0.011 |

0.045 |

0.003 |

0.004 |

0.002 |

0.018 |

0.005 |

0.001 |

59 |

0.012 |

0.002 |

0.012 |

0.026 |

0.020 |

0.011 |

0.002 |

0.003 |

0.003 |

0.004 |

0.015 |

61 |

0.169 |

0.308 |

0.489 |

0.077 |

0.109 |

0.051 |

0.014 |

0.033 |

0.036 |

0.017 |

0.024 |

62 |

0.000 |

0.000 |

0.000 |

0.000 |

0.002 |

0.001 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

63 |

0.000 |

0.029 |

0.011 |

0.008 |

0.000 |

0.004 |

0.004 |

0.008 |

0.018 |

0.007 |

0.005 |

64 |

0.000 |

0.004 |

0.000 |

0.000 |

0.011 |

0.005 |

0.001 |

0.000 |

0.000 |

0.001 |

0.007 |

65 |

0.163 |

0.146 |

0.289 |

0.411 |

0.486 |

0.728 |

0.780 |

0.885 |

0.853 |

0.634 |

0.799 |

66 |

0.029 |

0.048 |

0.014 |

0.012 |

0.034 |

0.027 |

0.050 |

0.020 |

0.024 |

0.062 |

0.051 |

67 |

0.000 |

0.000 |

0.000 |

0.001 |

0.000 |

0.004 |

0.000 |

0.004 |

0.115 |

0.021 |

0.066 |

68 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.030 |

0.053 |

0.145 |

0.314 |

0.593 |

0.452 |

69 |

0.054 |

0.068 |

0.088 |

0.082 |

0.084 |

0.131 |

0.083 |

0.092 |

0.046 |

0.043 |

0.033 |

71 |

0.000 |

0.000 |

0.000 |

0.048 |

0.072 |

0.000 |

0.002 |

0.002 |

0.001 |

0.007 |

0.005 |

72 |

0.022 |

0.001 |

0.000 |

0.010 |

0.002 |

0.011 |

0.010 |

0.072 |

0.016 |

0.064 |

0.085 |

73 |

0.000 |

0.000 |

0.000 |

0.001 |

0.072 |

0.000 |

0.001 |

0.000 |

0.000 |

0.000 |

0.022 |

74 |

0.000 |

0.011 |

0.001 |

0.000 |

0.002 |

0.000 |

0.001 |

0.003 |

0.005 |

0.052 |

0.005 |

75 |

0.0004 |

0.000 |

0.000 |

0.012 |

0.002 |

0.002 |

0.002 |

0.006 |

0.001 |

0.004 |

0.0005 |

76 |

0.000 |

0.000 |

0.008 |

0.000 |

0.001 |

0.002 |

0.000 |

0.001 |

0.001 |

0.009 |

0.006 |

77 |

0.005 |

0.000 |

0.000 |

0.001 |

0.027 |

0.000 |

0.003 |

0.004 |

0.003 |

0.002 |

0.003 |

78 |

0.048 |

0.218 |

0.000 |

0.002 |

0.002 |

0.007 |

0.004 |

0.013 |

0.011 |

0.026 |

0.0001 |

79 |

0.160 |

0.031 |

0.019 |

0.000 |

0.000 |

0.000 |

0.010 |

0.000 |

0.068 |

0.000 |

0.536 |

81 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.001 |

0.000 |

0.016 |

0.000 |

0.011 |

82 |

0.201 |

0.000 |

0.149 |

0.050 |

0.246 |

0.017 |

0.010 |

0.008 |

0.006 |

0.083 |

0.073 |

83 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.014 |

0.000 |

0.025 |

0.005 |

0.006 |

0.012 |

85 |

0.001 |

0.025 |

0.002 |

0.017 |

0.014 |

0.019 |

0.001 |

0.006 |

0.009 |

0.001 |

0.000 |

87 |

0.240 |

0.033 |

0.035 |

0.057 |

0.048 |

0.116 |

0.059 |

0.070 |

0.063 |

0.137 |

0.247 |

88 |

0.006 |

0.000 |

0.000 |

0.000 |

0.000 |

0.000 |

0.629 |

0.000 |

0.000 |

0.000 |

0.000 |

89 |

0.089 |

0.138 |

0.083 |

0.097 |

0.133 |

0.079 |

0.000 |

0.081 |

0.098 |

0.074 |

0.049 |

93 |

0.377 |

0.933 |

0.030 |

0.021 |

0.157 |

0.086 |

0.100 |

0.003 |

0.263 |

0.001 |

0.007 |

Variations in indicators (i.e. TT, NT, IIT, GL indexes and r) over the period 2004-2014 have been utilized to identify/measure the potential adjustment problems connected with greater trade. Industries are clustered based on regions identified in Figure 1, Figure 1 has also been used to analyze the factor adjustment inference of changes in the trade points.

|

2004 |

|

2014 |

||||||

SITC |

rx |

rm |

|

rx |

rm |

∆TT |

∆NT |

∆ IIT |

∆GL |

∆TT > 0 |

|

|

|

|

|

|

|

|

|

Region I |

|

|

|

|

|

|

|

|

|

61 |

10.9 |

|

|

83.2 |

|

28.685 |

30.610 |

-1.925 |

-0.145 |

Region II |

|

|

|

|

|

|

|

|

|

27 |

|

3.1 |

|

5.5 |

|

31.298 |

22.060 |

9.238 |

-0.189 |

28 |

11.1 |

|

|

75.7 |

|

152.26 |

148.98 |

3.278 |

-0.140 |

Region III |

|

|

|

|

|

|

|

|

|

03 |

18444 |

|

|

1170 |

|

52.235 |

52.122 |

0.114 |

0.002 |

08 |

|

- |

|

3.3 |

|

34.619 |

18.269 |

16.349 |

0.472 |

21 |

|

- |

|

107.4 |

|

0.970 |

0.952 |

0.018 |

0.018 |

29 |

4.9 |

|

|

1.8 |

|

11.298 |

3.016 |

8.282 |

0.370 |

33 |

3.1 |

|

|

2.7 |

|

20.793 |

9.349 |

11.444 |

0.047 |

65 |

11.3 |

|

|

1.5 |

|

1257.1 |

141.03 |

1116.1 |

0.636 |

Region VI |

|

|

|

|

|

|

|

|

|

00 |

|

- |

|

|

- |

0.004 |

0.004 |

0.000 |

0.000 |

01 |

- |

|

|

|

11.5 |

0.007 |

0.004 |

0.003 |

0.161 |

02 |

|

- |

|

|

- |

0.194 |

0.194 |

0.000 |

0.000 |

04 |

10.7 |

|

|

|

7.2 |

12.270 |

9.266 |

3.004 |

0.072 |

05 |

|

45.1 |

|

|

18.1 |

92.659 |

81.633 |

11.025 |

0.062 |

11 |

|

- |

|

|

428.1 |

0.152 |

0.151 |

0.001 |

0.005 |

12 |

|

|

|

|

- |

0.006 |

0.006 |

0.000 |

0.000 |

22 |

|

2.8 |

|

|

1.7 |

8.653 |

2.154 |

6.499 |

0.222 |

24 |

|

- |

|

|

- |

0.614 |

0.614 |

0.000 |

0.000 |

25 |

|

- |

|

|

- |

0.473 |

0.473 |

0.000 |

0.000 |

26 |

19.6 |

|

|

|

2.3 |

235.74 |

84.280 |

151.46 |

0.521 |

34 |

|

|

|

|

- |

0.976 |

0.976 |

0.000 |

0.000 |

41 |

|

|

|

|

2.1 |

0.219 |

0.077 |

0.142 |

0.651 |

42 |

|

- |

|

|

1062.8 |

0.505 |

0.504 |

0.001 |

0.002 |

43 |

|

- |

|

|

13.660 |

0.548 |

0.470 |

0.079 |

0.136 |

52 |

|

- |

|

|

622.2 |

70.911 |

70.603 |

0.307 |

0.003 |

53 |

|

40390 |

|

|

147.0 |

72.044 |

70.798 |

1.247 |

0.013 |

56 |

|

- |

|

|

- |

119.06 |

119.06 |

0.000 |

0.000 |

57 |

|

2.3 |

|

|

1.5 |

88.023 |

16.571 |

71.452 |

0.185 |

58 |

|

- |

|

|

1986.5 |

39.561 |

39.520 |

0.041 |

0.001 |

59 |

|

160.5 |

|

|

132.2 |

88.316 |

86.881 |

1.436 |

0.003 |

62 |

|

- |

|

|

151619.1 |

94.347 |

94.345 |

0.002 |

0.000 |

63 |

|

- |

|

|

425.8 |

10.101 |

10.053 |

0.048 |

0.005 |

64 |

|

- |

|

|

267.5 |

50.120 |

49.730 |

0.390 |

0.007 |

66 |

|

68.7 |

|

|

38.2 |

90.851 |

85.946 |

4.905 |

0.022 |

67 |

|

- |

|

|

29.3 |

273.83 |

254.18 |

19.655 |

0.066 |

68 |

|

- |

|

|

3.4 |

59.416 |

30.901 |

28.515 |

0.452 |

71 |

|

- |

|

|

376.1 |

347.84 |

345.85 |

1.993 |

0.005 |

72 |

|

91.4 |

|

|

22.4 |

199.95 |

180.44 |

19.514 |

0.064 |

73 |

|

- |

|

|

88.0 |

10.029 |

9.748 |

0.280 |

0.022 |

74 |

|

- |

|

|

436.4 |

344.49 |

342.85 |

1.647 |

0.005 |

75 |

|

4792.7 |

|

|

4112.6 |

36.766 |

36.746 |

0.019 |

0.000 |

76 |

|

- |

|

|

313.7 |

608.59 |

604.61 |

3.981 |

0.006 |

79 |

|

11.5 |

|

|

2.7 |

112.67 |

51.578 |

61.089 |

0.377 |

81 |

|

- |

|

|

186.4 |

17.443 |

17.239 |

0.204 |

0.011 |

83 |

|

- |

|

|

160.8 |

9.886 |

9.757 |

0.129 |

0.012 |

85 |

|

2842.3 |

|

|

6190.3 |

49.311 |

49.296 |

0.015 |

0.000 |

87 |

|

7.336 |

|

|

7.1 |

57.221 |

42.960 |

14.261 |

0.008 |

Region VII |

|

|

|

|

- |

|

|

|

|

54 |

|

70.8 |

|

|

314.2 |

77.367 |

77.353 |

0.015 |

-0.021 |

55 |

|

15.1 |

|

|

253.0 |

23.480 |

23.407 |

0.073 |

-0.117 |

69 |

|

36.3 |

|

|

59.3 |

141.47 |

137.14 |

4.333 |

-0.020 |

77 |

|

415.7 |

|

|

722.6 |

369.73 |

368.76 |

0.972 |

-0.002 |

82 |

|

8.9 |

|

|

26.3 |

8.104 |

7.523 |

0.581 |

-0.128 |

89 |

|

21.5 |

|

|

39.6 |

136.46 |

130.29 |

6.158 |

-0.040 |

Region VIII |

|

|

|

|

|

|

|

|

|

07 |

|

3.3 |

|

|

43488.7 |

36.417 |

38.795 |

-2.378 |

-0.457 |

09 |

|

7.2 |

|

|

- |

4.942 |

4.965 |

-0.023 |

-0.246 |

51 |

|

1.6 |

|

|

47.8 |

210.82 |

240.52 |

-29.698 |

-0.723 |

78 |

|

40.9 |

|

|

18008.4 |

92.236 |

92.522 |

-0.285 |

-0.048 |

88 |

|

356.5 |

|

|

- |

7.761 |

7.781 |

-0.020 |

-0.006 |

93 |

|

4.300 |

|

|

297.5 |

0.267 |

0.539 |

-0.272 |

-0.371 |

∆TT < 0 |

|

|

|

|

|

|

|

|

|

06 |

|

1980.9 |

|

|

88.1 |

-55.841 |

-55.947 |

0.106 |

0.021 |

32 |

|

- |

|

|

- |

-3.009 |

-3.009 |

0.000 |

0.000 |

In Table 3, ![]() and

and ![]() denote to understand the movement in trend of trade balance (i.e. from net exporter to net importer and from net exporter to net importer). First difference operator is denoted by ∆. ∆TT, ∆NT, ∆IIT, and ∆GL denote first difference of total trade, net trade, intra-industry trade, and Grubel-Lloyd index respectively.

denote to understand the movement in trend of trade balance (i.e. from net exporter to net importer and from net exporter to net importer). First difference operator is denoted by ∆. ∆TT, ∆NT, ∆IIT, and ∆GL denote first difference of total trade, net trade, intra-industry trade, and Grubel-Lloyd index respectively.

Net exporter plane = ![]()

Net importer plane = ![]()

The first four regions (i.e. Region I, Region II, Region III and Region IV) are free from the adjustment problems and remains in net exporter plane. The remaining four regions (i.e. Region V, Region VI, Region VII and Region VIII) are net importer plane rather than in net exporter plane (see Figure A.1).

Clark (2009) documented that a huge rise in the value of TT can lead to value of IIT increasing more than NT. So, the decrease in GL index could be small relative to an increase in ![]() . These fluctuations give some scope for factor reallocation. At this juncture, factor adjustment problems are exercised only if growth of NT goes above relative IIT growth. The presence of potential adjustment pressures depend on the shifting of an economy or industry from point A to another point within the limit of Region VIII. Huge increases in value of

. These fluctuations give some scope for factor reallocation. At this juncture, factor adjustment problems are exercised only if growth of NT goes above relative IIT growth. The presence of potential adjustment pressures depend on the shifting of an economy or industry from point A to another point within the limit of Region VIII. Huge increases in value of ![]() are linked with decreases of both GL index and IIT, but raises in NT. At this point, imports increase and exports go down. A pronounced comparative disadvantage exists in Industries or economies that shift into Region VIII.

are linked with decreases of both GL index and IIT, but raises in NT. At this point, imports increase and exports go down. A pronounced comparative disadvantage exists in Industries or economies that shift into Region VIII.

Our findings (see Table A.3) show that Region I has one industry (SITC 61), which was in net exporter plane during the period under consideration; this industry practiced a huge raise in ![]() based on the fast export growth. Both IIT and GL index are cut down with the boost in

based on the fast export growth. Both IIT and GL index are cut down with the boost in ![]() .

.

Two industries (i.e. SITC 27 & SITC 28) fall into Region II. Out of these two industries, one industry (SITC 27) switched from net importer plane to net exporter plane and other industry as a net exporter plane over the 2004-2014 period experienced a large increase in the ![]() . IIT, TT and NT increased, and the GL index was cut down. NT grew more as compared to the IIT. These industries are not anticipated to face adjustment pressures because they are engaged in net exporter plane, in line with Clark (2009).

. IIT, TT and NT increased, and the GL index was cut down. NT grew more as compared to the IIT. These industries are not anticipated to face adjustment pressures because they are engaged in net exporter plane, in line with Clark (2009).

Six industries (i.e. SITC 03, SITC 08, SITC 21, SITC 29, SITC 33 and SITC 65) appeared in Region V. Imports grew quicker than the exports but all of these industries fall under net exporter plane. In all these six industries, IIT, NT, TT and GL index rose. NT grew faster as compared to IIT in one industry. These industries are also not anticipated to face adjustment pressures because they are also engaged in net exporter plane.

Thirty-five industries fall in Region VI. Out of these industries, two industries (i.e. SITC 04 and SITC 26) switched from net exporter plane to net importer plane because imports grew quickly as compared to exports. Other industries remained net exporter plane over the period 2004-2014. ![]() decreased in case of eleven industries because of increasing exports as compared to imports. In case of sixteen industries, their base period showed that these industries did not export but their imports increase as compared to their exports over the period under consideration. TT, GL index, NT and IIT rose in case of all the industries but NT grew faster than IIT in case of thirty industries. These findings are similar to Jambor (2003) who found that a shift from point ‘A’ to a point in region VI can give adjustment problems because the nation has transferred from net exporter to net importer. Export expansion will give some scope for factor reallocation. These movements do not put forward that Pakistan-China FTA is the reason of adjustment pressure for Pakistan.

decreased in case of eleven industries because of increasing exports as compared to imports. In case of sixteen industries, their base period showed that these industries did not export but their imports increase as compared to their exports over the period under consideration. TT, GL index, NT and IIT rose in case of all the industries but NT grew faster than IIT in case of thirty industries. These findings are similar to Jambor (2003) who found that a shift from point ‘A’ to a point in region VI can give adjustment problems because the nation has transferred from net exporter to net importer. Export expansion will give some scope for factor reallocation. These movements do not put forward that Pakistan-China FTA is the reason of adjustment pressure for Pakistan.

Region VII has six industries (i.e. SITC 54, SITC 55, SITC 69, SITC 77, SITC 82 and SITC 89) in net importer plane. Moving from point ‘A’ to a point in Region VII, a link can be developed with potential adjustment problems. When an increase in NT goes over IIT expansion by a narrow margin, then a raise in exports might be sufficient to give some capacity for factor reallocation. A raise in ![]() shows imports growing quicker than exports. NT, IIT and TT grew in case of all these industries but the GL index fell. Similar to Clark (2013), all of these industries may be applicants for the adjustment pressures because in case of these industries, NT growth is more than IIT growth.

shows imports growing quicker than exports. NT, IIT and TT grew in case of all these industries but the GL index fell. Similar to Clark (2013), all of these industries may be applicants for the adjustment pressures because in case of these industries, NT growth is more than IIT growth.

Region VIII has also six industries (i.e. SITC 07, SITC 09, SITC 51, SITC 78, SITC 88 and SITC 93). These industries remained in net importer plane over the period under consideration. Out of these six industries, two industries did not show any export in 2014. All industries practiced a huge raise in ![]() because of increasing imports as compared to exports. NT also changes with a large increase in case of all industries but IIT and GL index show decrease. Industries may be pronounced for the adjustment problems, which fall in Region VIII. The past movements in intra-industry specialization indicators show that these industries may be applicants to practice the factor adjustment pressures.

because of increasing imports as compared to exports. NT also changes with a large increase in case of all industries but IIT and GL index show decrease. Industries may be pronounced for the adjustment problems, which fall in Region VIII. The past movements in intra-industry specialization indicators show that these industries may be applicants to practice the factor adjustment pressures.

However, in general our results are consistent with previous empirical studies (Clark, 2009; Jambor, 2013 & Clark, 2013). Two industries (i.e. SITC 06 and SITC 32) show decline in TT during the period of 2004-2014. These industries also remained in net importer plane over the period under consideration. Value of ![]() decreased in case of SITC 06 because exports rose relative to imports; IIT also rose and NT fell. So, in this case, it does not contain the adjustment pressures. SITC code 32 industry did not export during the period under consideration. NT and TT decrease due to falling import levels. So, this industry will not practice adjustment pressures.

decreased in case of SITC 06 because exports rose relative to imports; IIT also rose and NT fell. So, in this case, it does not contain the adjustment pressures. SITC code 32 industry did not export during the period under consideration. NT and TT decrease due to falling import levels. So, this industry will not practice adjustment pressures.

Conclusions

A significant scope has been found by present study for intra-industry specialization between China and Pakistan. A small number of industries of both economies encountered the adjustment problems over the period of analysis. Only twelve industries are applicants for adjustment pressures out of sixty-one industries (i.e. SITC 07, SITC 09, SITC 51, SITC 54, SITC 55, SITC 69, SITC 77, SITC 78, SITC 82, SITC 93, SITC 88 and SITC 89). These industries share 15% of the total import of Pakistan, 24 % of total imports of China. In line with Bernatonytė and Normantienė (2015) findings show that IIT seems to be an appropriate tool, which provides extra benefits from the international trade as compared to comparative advantage because IIT allows the concerned countries to get advantage from the larger markets. Based on the detection of out of sight factors adjustment problems, import safeguard can be employed. It is further suggested that the time period of the phases of tariffs and bound rates may be stretched to get free from factor adjustment problems in the import sensitive sectors. Therefore, our findings facilitate the regulatory authorities to implement the controls on tariffs and rates to reduce the factor adjustment problems, and enhance the economic growth through trade of sensitive sectors of both nations.

The paper has used only Pakistan China Intra Industry data to derive the results. For future research, it may need to look at the complete intra-industry data for Pakistan with all its trading partner, and more specifically with Shanghai Cooperation Organisation (SCO) permanent members. As, Pakistan and India have become permanent members of the SCO recently, therefore, it may be useful to examine intra-industry trade among Shanghai Cooperation Organisation (SCO). It may be the case, that there is a shift in Pakistan's export from China to some other country because (a) either the other country is offering a better price compared to China or (b) it is less costly to send it to the other country. If then the industry is facing factor adjustment problems, then it should try to assess what sort of issues might arise and how they can be addressed? Future researchers may also need to analyze (a) the trade flow among SCO member countries, and (b) potential for free trade area, which will lead towards possible solution/suggestions if the industries among SCO member countries are facing factor adjustment problems.

Bibliography

Unpublished Archival Documents

Commerce.gov.pk., [2006]: "Free Trade Agreement between the Government of Islamic Republic of Pakistan and the Government People's Republic of China," 25 April 2012, http://www.commerce.gov.pk/PK-CN(FTA)/Pak-China_FTA_Agreement.pdf. Accessed 25 April 2012.

Comtrade.un.org., [2012]: "United Nation Commodity Trade Statistics Database (UN COMTRADE)," 25 April 2012, http://comtrade.un.org/. Accessed 25 April 2012.

Published Books

Grubel, H. G., & Lloyd, P. J., [1975]: Intra-Industry Trade: The Theory and Measurement of International Trade in Differentiated Products. Macmillan, London.

Keynes, J. M., [2006]: General theory of employment, interest and money. Atlantic Publishers & Dist.

Siddique, M. A., [2007]: Regionalism, Trade and Economic Development in the Asia Pacific Region. Bodmin, Cornwaa: MPG Books Ltd.

Periodicals

Azhar, A. K., Elliott, R. J., & Milner, C. R., [1998]: Static and dynamic measurement of intra-industry trade and adjustment: A geometric reappraisal.Weltwirtschaftliches Archiv, 134(3), 404-422.

Bernatonytė, D., & Normantienė, A. , [2015]: Estimation of importance of Intra-industry Trade. Engineering Economics, 53(3).

Clark, D. P. , [2009]: Adjustment Problems in Developing Countries and the US-Central America-Dominican Republic Free Trade Agreement. The International Trade Journal, 23(1), 31-53.

Clark, D. P., [2002]: Intra-Industry Specialization and the North American Free Trade Agreement. The International Trade Journal, 16(4), 393-411.

Clark, D. P., [2013]: Intra-Industry Specialization in United States–China Trade. The International Trade Journal, 27(3), 225-242.

Jambor, A., [2014]: Country‐Specific Determinants of Horizontal and Vertical Intra‐industry Agri‐food Trade: The Case of the EU New Member States. Journal of Agricultural Economics, 65(3), 663-682.

Shelburne, R. C., [1993]: Changing trade patterns and the intra-industry trade index: a note. Review of World Economics, 129(4), 829-833.

* Ph.D. Research Scholar, Faculty of Commerce, University of Central Punjab, Lahore, Pakistan.

** Currently serves as Associate Dean, Faculty of Commerce, University of Central Punjab, Lahore, Pakistan.

Siddique, M. A., Regionalism, Trade and Economic Development in the Asia Pacific Region. Bodmin, Cornwaa: MPG Books Ltd. 2007